Inheriting a mobile home can be a trying time for families. Dealing with the death of a loved one is difficult enough on its own – add the complexities of state government offices, needlessly difficult laws, and the typical misinformation that surrounds mobile homes, and you have a recipe for disaster.

We’re going to try to simplify the process of inheriting a mobile home in this article. We’ll cover the most common terms and definitions you should know about wills and inheritances, as well as the most basic laws that affect your wallet when inheriting a mobile home.

Basics of Inheriting a Mobile Home

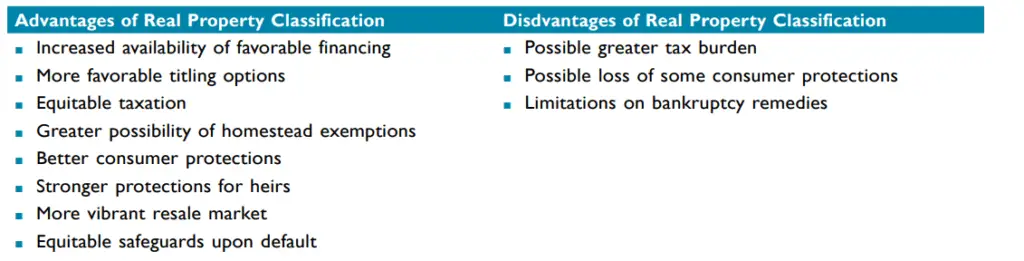

Mobile and manufactured homes can be classified as either real property or personal property. The classification affects the inheritance process.

Another factor that affects the inheritance process is whether the home is paid off or still financed.

Real Property

To be classified as real property, the mobile home must be permanently installed to the land using the rules and regulations of your state.

Once the mobile home has been deeded as real property, you must follow your state’s real estate probate law.

Personal Property

If the mobile home is in a park, it will almost always be classified (and taxed) as personal property. However, being in a park will complicate things. You will need to get the park’s permission to move in, rent it out, move it out, or sell it. It’s smart to hire an attorney for these situations.

A mobile home is classified and titled as personal property with a value of $10,000 or less (in most states) it will typically be handled just like a vehicle.

If the home is classified as personal property

Suppose the home is paid for, and the title is held in your loved one’s name only (and there are no other beneficiaries or heirs). In that case, you should be able to take the required documents (death certificate, etc.) to the DMV and have the title transferred to you just as you would a vehicle.

If you’ve received a mobile home through a deed:

If a mobile home is held in a deed, it should be fairly easy to be transferred to you without going through the probate procedure. Selling should be simple because your initials will be on the title (please double-check Texas last will and testament laws as it reads a bit differently).

Have you received a mobile home through a trust?

If a mobile home is classified as real property and held in a trust, it may be transferred to you immediately if the deceased person had a trust deed that states that you will inherit it after they pass.

However, if the deceased left a spouse or minor children, you will likely need to go through probate to transfer ownership into your name.

Should you keep, sell, or rent an inherited mobile home?

After gathering the necessary financial information, assessing the home’s condition, and consulting with other parties, it’s time to decide what to do with the mobile home you’ve inherited.

Several monetary, cultural, and market factors will affect the choice of whether to keep it, rent it out, or sell it.

The estate may satisfy any outstanding mortgage. After that, you buy a house with no debt. The tax treatment varies based on how long you’ve lived there (at least two years).

When you finally sell the home, you’ll be eligible for the current principal residence capital gains exemptions, which are $250,000 for singles and $500,000 for marriages filing jointly.

Keeping a mobile home You’ve inherited

Even without paying a mortgage, owning a home can still be expensive. Expenses like electricity, heating, property taxes, liability insurance, homeowner’s insurance, and normal wear and tear can have a significant negative impact on your finances.

The financial impact of keeping an inherited mobile home:

You will be responsible for paying for maintenance, fees, and other unforeseen costs of homeownership whether you make a mortgage payment.

Tax liability of keeping an inherited mobile home

Usually, you won’t incur any additional taxes by just inheriting a house, except the yearly real estate taxes you’ll pay as the new landlord.

Selling an Inherited mobile home:

Inheriting a mobile home isn’t always convenient, and a ‘free’ home isn’t always free. In many cases, it’s smart to sell the inherited mobile home.

Of course, it’s vital that you get an expert’s advice for your particular situation before doing anything.

Choose a starting offer by comparing it to those for similar adjacent homes. Make sure the previous owner had the insurance, that it is up to date and that the estate or trust is insured in case something were to happen to the home between the time of your loved one’s passing and the sale. Any mortgage payments, energy costs, and property taxes follow the same pattern.

Remember that arranging for a property to be sold takes time if you intend to sell. You need to go through the entire house. A lifetime spent worth of belongings may occasionally fill all free capacity in the home.

The financial impact of selling the mobile home

You will be responsible for paying all costs related to marketing your home, including any required repairs, agent fees, staging costs, and closing costs.

Tax liability of selling the mobile home

If you fall inside a certain tax bracket, the difference between the home’s fair market value when you inherit it, and the sale price will be liable to capital gains taxes.

Renting the mobile home

If you do not wish to sell the property or move in, you could decide to rent the area. A monthly taxable income from renting is possible. That would be a smart move if the residence’s owner was nearing retirement.

The financial impact of renting the mobile home

You must first prepare the house for rental purposes. Then take into account expenses for property management, tenant gaps, and 24-hour maintenance assistance.

Tax liability of renting the mobile home

You will be required to pay property taxes like any other home you own. However, you can claim a tax deduction for maintenance and repair costs.

Inheritance tax when a mobile home is inherited

If you sell a property for more than you previously paid, capital gains taxes might well be owed. You might still owe taxes if you want to sell an inherited home.

In addition, inheritance and estate taxes need to be considered. Only six states—Maryland, Nebraska, New Jersey, Iowa, Kentucky, and Pennsylvania—impose an inheritance tax. Federal estate taxes apply whenever a family has assets worth more than $5.43 million. Political controversies and inflation cause yearly wide variations in tax rates.

Surviving spouses are completely exempt from taxes. Estate taxes must be paid when a property valued at more than $10 million is transferred after death.

Taxes are a factor in the purchase, sale, and rental of inherited property, but the kind and size of taxes you’ll be required to pay may vary depending on your choice and circumstances.

Estate Taxes

The new owner of the inherited property will need to pay tax on its market value. We recommend contacting a tax professional to discuss options for calculating fair market value.

Capital Gains Taxes

If you decide to sell your inherited properties for more than the current market value of the property, you must pay capital gains taxes on the difference between the sale price and the market value.

There is one tax-related loophole that can assist heirs if they are willing to reduce capital gains somehow.

‘Raising the base’ prevents the heir from paying more capital gains taxes than necessary by limiting the tax liability of the heir to the assessed value between the date of the original owner’s death and the day the heir decides to sell the property.

PS We are not financial advisors. Please consult a licensed professional for proper financial information.