As the creator of Mobile Home Living, it’s obvious that I’m an advocate of factory-built homes. Over the last 3.5 years I hope I’ve made it clear that while I love the homes, I’m not a fan of the manufactured home industry at all. I feel there’s a lot of room for improvement! Especially concerning the dealer-financed manufactured home trap.

If I had my way, everyone would buy used homes from private sellers or only use financing from a private bank but I know that’s not possible. Over the years I’ve tried to provide a lot of helpful advice and tips for those buying a new home. Education is power and that’s especially true when it comes to buying a new manufactured home.

The Dealer-Financed Manufactured Home Trap

The Seattle Times published an article:

The Mobile-Home Trap: How a Warren Buffett Empire Preys on the Poor

It was based on the article released by the Center for Public Integrity:

Warren Buffett’s Mobile Home Empire Preys on the Poor

Both are well-written articles with a lot of great points and I hope you’ll take the time to read them, especially if you’re in the market for a new manufactured home. There are a lot of good key points involving dealer financing issues. Here are a few of them:

Obtain Your Own Private Financing

The best piece of advice anyone can give a potential manufactured home-buyer is to obtain your own financing before setting foot on a dealer’s lot.

Obtaining financing through the dealers is not advisable and should be avoided at all costs. Dealer financing has higher interest rates, lower down-payment requirements, and longer terms.

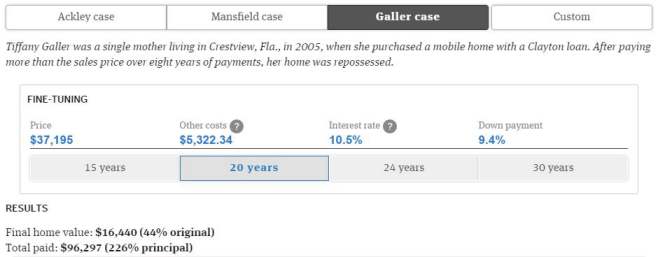

Take a look at the following loans of actual Clayton home buyers. Each scenario is a prime example of the issues of financing a home through a dealer:

Ackler Family

Mansfield Family

Galler Family

You can read more financing stories on the Center for Public Integrity’s website here.

Shop Around with TRUE Competitors

The second piece of advice is to shop around. Unfortunately, there’s a major issue that you’ll likely incur when trying to shop around and that’s the fact that one manufacturer can go by several different names.

Clayton Homes, the Warren Buffet company, operates under 18 different names! Ever heard of Oakwood Homes or Luv Homes or TruValue? They are all Clayton companies!

The homes come from the same factories and dealer financing is through the same finance companies, they are simply operating under different names.

Be Wary of Commissioned Salespeople

A manufactured home dealer is similar to a used car dealer because they have salespeople working on commission.

Salespeople that work on commission sets the stage for most of the issues manufactured home buyers experience such as deception and misrepresentation. I believe if the industry is ever going to change for the better, it will need to get rid of the commission based salaries.

Salespeople have to feed their families and that can make for desperation. Desperate people will do anything.

Chances Are, You Will NOT Be Able to Refinance

Banks refinance and modify loans. Dealer-financed manufactured home companies typically do not.

In the article, The Mobile Home Trap, the author spoke to several Clayton finance customers:

Nine Clayton consumers interviewed for this story said they were promised a chance to refinance. In reality, Clayton almost never refinances loans and accounts for well under 1 percent of mobile-home refinancings reported in government data from 2010 to 2013. It made more than one-third of the purchase loans during that period.

In general, owners have difficulty refinancing or selling their mobile homes because few lenders offer such loans. One big reason: Homes are overpriced or depreciate so quickly that they generally are worth less than what the borrower owes, even after years of monthly payments.

Appreciation is Not Likely (though it is possible)

Manufactured homes typically only appreciate (or gain value) if they are permanently installed on the land. In reality, it’s the land that is gaining the value, not the home in the most common cases.

Still, there’s been a few studies showing that mobile and manufactured homes CAN appreciate (click here to read about it). It’s an interesting study that proved more manufactured homes appreciated than depreciated.

Ellie Carosa, of Napavine, Wash., found this out the hard way in 2010 after she put down about $40,000 from an inheritance to buy a used home from Clayton priced at about $65,000.

Clayton sales reps steered Carosa, who is 67 years old and disabled, to finance the unpaid amount through Vanderbilt at 9 percent interest over 20 years.

One year later, Carosa was already having problems — peeling paint and failing carpets — that she decided to have a market expert assess the value of her home. She hoped to eventually sell the house so the money could help her biological granddaughter, whom she adopted as her daughter at age 8, attend a local college to study music.

Carosa was stunned to learn that the home was worth only $35,000, far less than her original down payment.

New Manufactured Homes Can be Overpriced

The typical profit on a manufactured home is over $11,000!

Clayton’s own data suggest that its mobile homes may be overpriced from the start, according to court documents and comments filed with federal regulators by its general counsel.

When Vanderbilt was required to obtain appraisals before finalizing a loan, he wrote, the home was determined to be worth less than the sales price about 30 percent of the time. Another Clayton executive said in a 2012 affidavit that the average profit margin on Clayton homes sold in Arkansas between 2006 and 2009 was $11,170 — roughly one-fifth of the average sales price of the homes.

Don’t Be Late on Payments!

Once you’re late on a payment, you could be less than 60 days away from having your home repossessed.

Berkshire’s borrowers who fall behind on their payments face harassing, potentially illegal phone calls from a company rarely willing to offer relief.

Carol Carroll, a nurse living near Bug Tussle, Ala., began looking for a new home in 2003 after her husband died, leaving her with a six-year-old daughter. Instead of a down payment, she said, the salesman assured her she could simply put up two acres of her family land as collateral.

In December 2005, Carroll was permanently disabled in a catastrophic car accident in which two people were killed. Knowing it would take a few months for her disability benefits to be approved, Carroll said she called Vanderbilt and asked for a temporary reprieve. The company’s answer, she said: “We don’t do that.”

However, Clayton ratcheted up her property insurance premiums, eventually costing her $803 more per year than when she started, she said. Carroll was one of several Clayton borrowers who felt trapped in the company’s insurance, often because they were told they had no other options. Some had as many as five years’ worth of expensive premiums included in their loans, inflating the total balance to be repaid with interest. Others said they were misled into signing up even though they already had other insurance.

Carroll has since sold belongings, borrowed from relatives and cut back on groceries to make payments. When she was late, she spoke frequently to Clayton’s phone agents, whom she described as “the rudest, most condescending people I have ever dealt with.” It’s a characterization echoed by almost every borrower interviewed for this story.

Consumers say the company’s response to pleas for help is an invasive interrogation about their family budgets, including how much they spend on food, toiletries and utilities. Denise Pitts, of Knoxville, said Vanderbilt collectors have called her multiple times a day, with one suggesting that she cancel her internet service, even though she home schools her son. They have called her relatives and neighbors, a tactic other borrowers reported.

After Pitts’ husband, Kirk, was diagnosed with aggressive cancer, she said, a Vanderbilt agent told her she should make the house payment her “first priority” and let medical bills go unpaid. She said the company has threatened to seize her property immediately, even though the legal process to do so would take at least several months.

There May Be Less Consumer Protection Afforded to You When Financing Through a Dealer

Dealer financing falls through the cracks of consumer protection.

Many mobile home buyers finance their purchases with personal property loans, which typically have fewer federal and state protections than regular home mortgages. Their homes, for example, can be seized with little or no warning. With regular mortgages, by contrast, companies must wait 120 days before starting foreclosure.

“They entrap you,” Carroll said. “They give you a loan that you can’t pay back and then they take from you.”

The Manufactured Home Industry is POWERFUL

For the last couple of years, I kept seeing advocacy for changes to the Dodd-Frank Act but no one could tell me why it was a good thing for the buyers.

In my opinion, classifying manufactured home financing with high-interest rates SHOULD be considered predatory lending practice, right?

After researching a bit, I understood exactly why I kept seeing article after article on manufactured home sites. These companies are making a fortune and can pay for the ‘advocacy’.

The government has known for years about concerns that mobile home buyers are treated unfairly. Little has been done.

Fifteen years ago, Congress directed the Department of Housing and Urban Development to examine issues such as loan terms and regulations in order to find ways to make mobile homes affordable. That’s still on HUD’s to-do list.

The industry, however, has protected its interests vigorously. Clayton Homes is represented in Washington by the Manufactured Housing Institute (MHI), a trade group that has a Clayton executive as its vice chairman and another as its secretary. CEO Kevin Clayton has represented MHI before Congress.

MHI spent $4.5 million since 2003 lobbying the federal government. Those efforts have helped the company escape much scrutiny, as has Buffett’s persona as a man of the people, analysts say.

“There is a Teflon aspect to Warren Buffett,” said James McRitchie, who runs a widely-read blog, Corporate Governance.

Still, after the housing crisis, lawmakers tightened protections for mortgage borrowers with a sweeping overhaul known as the Dodd-Frank Act, creating regulatory headaches for the mobile home industry. Kevin Clayton complained to lawmakers in 2011 that the new rules would lump in some of his company’s loans with “subprime, predatory” mortgages, making it harder for mobile home buyers “to obtain affordable financing.”

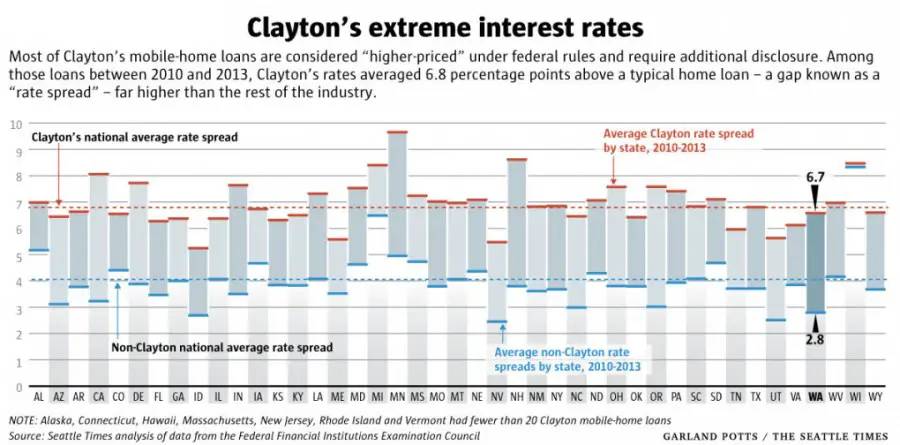

Although the rules had yet to take effect that year, 99 percent of Clayton’s mobile home loans were so expensive that they met the federal government’s “higher-priced” threshold.

Dodd-Frank also tasked federal financial regulators with creating appraisal requirements for risky loans. Appraisals are common for conventional home sales, protecting both the lender and the consumer from a bad deal.

But when federal agencies jointly proposed appraisal rules in September 2012, industry objections led them to exempt loans secured solely by a mobile home.

Then Clayton pushed for more concessions, arguing that mobile home loans secured by the home and land should also be exempt. Paul Nichols, then-president of Clayton’s Vanderbilt Mortgage, told regulators that the appraisal requirement would be costly and onerous, significantly reducing “the availability of affordable housing in the United States.”

In 2013, regulators conceded. They will not require a complete appraisal for new manufactured homes.

You Have To Do Your Homework

Of course, we cannot put all the blame on dealers and finance companies. In several situations, the buyers simply didn’t research like they should have.

If you’re struggling to pay for the home you already have, you probably shouldn’t be thinking of buying a new home. This rings true if you are not well-versed in the issues that dealer-financed manufactured homes have as well.

In addition, there’s a lot of people that simply do not understand how financing works in relation to depreciation and they get in over their heads without realizing what they’re doing.

Remember, education is power and being poor is not cheap.

Paycheck loan companies are making millions on the backs of hard-working people that simply needed a little help to make it until the next payday but end up in a vicious cycle. It’s the same with those buy here, pay here car lots and rent-to-own furniture stores. Making payments sounds like a great way to buy something but paying 4 times (or more) for the product is not the smartest thing a consumer can do.

You Can Still Get Fair Financing

Financing is not one-size-fits-all. With a great work history and high credit score, you can be eligible for very competitive loan terms at your bank. There’s even enticing dealer-financing available. Typically, the high-interest rates are for consumers with poor credit and low income.

If your credit is not so great you should probably wait a couple years before buying a home – your wallet will thank you! Take the time to raise your credit score and learn as much as you can about your options. Then walk onto the lot and start negotiating. Never sign anything until you completely understand every word and then pay an attorney or financial adviser to read over it too. Redundancy works!

Clayton’s Response

I think it’s only fair to release the letter I received from Clayton in response to these articles. Here’s what they had to say:

Clayton Homes Statement Regarding Misleading Reporting

MARYVILLE, Tenn., April 6, 2015 — Beginning with a provocative, political campaign-style

the video promoted via social media last Thursday, The Seattle Times and the Center for Public Integrity today published a misleading report about Clayton Homes. Here are the facts:

Manufactured housing plays a critical role in affordable housing in America, making up 50 percent of all new homes sold below $150,000. Clayton Homes, founded in 1956, will have the privilege of helping over 30,000 families with a new home this year.

Clayton Homes’ policies, procedures, and training are designed to ensure that customers have a choice of lenders. A list of all available lenders is posted and provided in company-owned retail locations. Customers are encouraged to select more than one lender so they can compare options – and select the loan program that best serves their needs. The retailer selling the home receives no financial incentives from the lender the customer chooses.

Clayton Homes’ finance companies have operated in the highly-regulated mortgage lending industry for more than 40 years. Just 90 days ago, The New York Times wrote, “what distinguished Clayton Homes was that its financing division, unlike that of competitors did not engage in predatory lending or exploit its customers’ naiveté`.” Our lending policy and procedures help ensure that we evaluate each customer’s reasonable ability to repay the loan for which they have applied. Appraisals are ordered from an unaffiliated third party on all loans secured by land that we finance, and a copy is provided to the customer prior to the closing of the loan.

All new home loans being originated are fixed rate and fully amortizing with an average term of 22 years. In the last 12 months, the average total down payment was just under 19 percent and customary closing fees are all disclosed to the customer. The only 30-year loans being offered by our lenders are through the government FHA title II loan program.

Interest rates on manufactured homes can be higher than loans for site-built homes because government-sponsored programs are not readily available for manufactured homes, the land is often not included in the loan, and the loan size is much smaller. Unlike lenders that originate loans and sell them to investors, we hold the loans on our books, assuming the risk throughout the life of the loan rather than passing the risk on to others.

The unfortunate reality is that some customers have trouble making their monthly payments when they experience a significant life-event – divorce, job loss, or medical issue. Our company’s policies, training, and monitoring are in place to comply with all applicable federal and state laws. When a home is foreclosed no one wins – the company loses money and more significantly the customer loses their home. A variety of loss mitigation options are offered to customers including payment extensions and loan modifications all to help customers stay in their homes. The company’s servicing practices were recently cited as best practices in The New York Times.

Customers shopping a company-owned location can easily compare models and features with pricing posted in all homes. Retail locations operate under various trade names in order to represent the many manufacturers of homes available in the market providing a broader selection for customers. Clayton Homes’ retail locations make up approximately 12% of the industry’s retail locations.

The overwhelming majority of Clayton Homes’ customers report high levels of satisfaction with their home purchase and mortgage, and we are honored to serve them in their communities. To read more about Clayton Homes, visit our About Us page.

About Clayton Homes

Clayton Homes has built quality homes since 1956, winning multiple awards for design and construction. Through its affiliates and family of brands, Clayton Homes builds, sells, finances, leases, and insures manufactured and modular homes, as well commercial and educational buildings. Clayton Homes is a vertically integrated Berkshire Hathaway company whose purpose is opening doors to a better life, one home at a time.

Additional Resources

If you’re in the market for a new manufactured home please take the time to read the following articles. They really can help you get a better deal and understand your options better:

30 Tips for Buying and Financing A Manufactured Home

Avoiding Issues During a Manufactured Home Purchase

Buying a Manufactured Home: Warranties and How to Handle Issues After the Sell

Insiders Guide to Manufactured Home Dealers

Manufactured Home Buying Tips

As always, thank you for reading Mobile and Manufactured Home Living!

Image Sources: TruckTrend, GalleryHip

Hi Katie,

Read the first few articles on these 2 links (there’s information about the FHA scattered throughout): https://mobilehomeliving.org/?s=financing and https://mobilehomeliving.org/?s=loan

There are a lot of stories out there about the land/home deals and a lot of them are bad. The issues occur when buyers don’t understand exactly what they are getting into but if you research and understand every detail of the deal you should be fine.

I think the banks or lending institutions will be your main contact and they will act on your behalf to the FHA. The person must be certified by the department so they are knowledgeable. I think the FHA just acts as a guarantor of the loan and whenever they are involved there will be a lot more rules and regulations but the banks are more apt to approve the loan.

A permanent foundation simply means the home is properly tied-down with the straps and tie-downs. A lot of people misunderstand it to mean that the home has to have cement or brick skirting and foundations. A home can be permanently installed without any skirting at all (If I’m understanding everything properly – I’m not an expert by any means).

While the following article is more for remodeling loans there are a lot of links and info about the government backed loans: https://mobilehomeliving.org/18-home-improvement-loans-and-grants-for-your-manufactured-home-remodel/

You are researching and that is the smartest thing any potential buyer can do. I like the idea of having a meeting with the counselors – you can never be too prepared or knowledgeable.

Best of luck! Let me know how it goes!

Love your site! So informative! :D

We live in Washington state. All of the sales lots up here advertise that they work with FHA and VA lending. I can’t find any information on how possible it is to achieve a loan for FHA/VA with a manufactured home vendor. I assume they find the financial institute willing to work with you. Just haven’t found anybody out there that went this route and it worked for them. In the area of WA, where we live anyways, manufactured homes on their own lot (not in a park) are required to be on permanent foundation and up to state/local building code standards, which the sales lots seem to advertise is true. So maybe that makes getting FHA/VA lending more attainable? I am not sure. They are even offering land/home packages, which is what we are most interested in. Do you have any expertise on how this works at all? We are going to a sales lot near here over the weekend but I hesitate to sit down with their financial person if it is a bad idea. If they actually can qualify us for VA or FHA loan then it shouldn’t be an issue, right?

Hi Kurt!

I’ve written quite a few articles that can help. Here’s all the articles about buying: https://mobilehomeliving.org/?s=buying

Here’s a couple of articles that I think will answer your question best:

https://mobilehomeliving.org/buying-your-first-used-manufactured-home-read-this/

https://mobilehomeliving.org/manufactured-home-inspection-checklist/ (this checklist needs re-designed but it has a lot of good tips and things to look for if you can get passed the poor formatting).

Basically, you want good bones (framing, flooring, roofing), goof wiring (and outlets, breaker boxes), and good plumbing. No sagging ceilings, no leaks, and no cracks. The plastic belly wrap under the home is usually a good indicator of maintenance – if the previous owner has patched the holes and kept the wrap in good condition they have likely done the same for the rest of the home (cause the belly wrap is a pain to work with).

While a lot of stuff can be updated and repaired there is a fine line between it making sense to do and it not. Best of luck!

Hello, Very informative, great website. O currently rent a late model manufactured home, and I came across a property with an existing home that needs some interior rehab. Can you givee some guidance as what be aware of before purchasing?? P.S. the home has a private well, and septic on it…

They charge interest rates like a personal loan rate. We can get a car loan now for 1% financing, but if we want to buy a manufactured home and mortgage it, our rate would likely be higher. Even with excellent credit over 800 and a good income. It’s discrimination toward a certain kind of home. I really don’t get how they get away with it anymore. When we move South and buy one in a community, we will pay cash. Not interested in giving the banksters any of our hard earned money anymore.

Hi Presey!

You are living the good life and I’m so happy for you! You work hard for everything you own and no one can take it away. It’s an honorable way to live!

I can’t wait to be able to say we are 100% debt-free (4 more years and our land will be paid off)! I’m gonna celebrate so much you may be able to hear me out in California!

Thank you so much for commenting and sharing with us. You’re a true inspiration! If you’re ever in WV please let me know – I’d love to meet you! I used to drive rock trucks and Yuks on strip mine reclamations – it was my favorite job ever!

I purchased my manufactured home from a private party/family for 8000.00 cash(bought outright), years ago, I put it on a rural North CA HOA(hoa dues/ year=150.00, to upkeep the roads) of 3.0 acres(15,000.00/bought outright, cash), rented it out a few times to some very responsible and clean adults over a few years time, now I live in my manufactured home & property, everything is beautiful. My manufactured home currently is under renovation, I truck drive for a nice income living with my husband and my doggie tig’z, life is all good. My annual expenses to live the way I am comfortable is as follows: Pg&e electric=approx 100.00-/month(I will be off-grid soon/solar), my telephone and IT=120.00(rural monopoly telephone/IT company, I don’t approve of monopolies at all, but stuck with them, trust me I tried not to be)and then of course gas, food, essentials of life. I am 0 debt~ratio, everything I own, I own outright. I maximize my earnings, by educating myself, and staying in touch with the economy swings. Life is good, and I live within my means. Crystal I thank you very much for your email postings, articles, and wisdom. Sincerely Presey, Tad, and Tig’z

Very informative Crystal! Thanks so much.