Manufactured homes are designed with the same perks as single-family homes and condos; the kitchens display granite counter tops, stainless steel appliances, custom-built fireplaces, and other high-end finishes. Many models cost as much as a site-built home and once permanently installed are classified as real property so when you’re shopping for insurance for manufactured homes in the marketplace you have several things to consider.

We’ll cover how to choose the right insurance company for your manufactured home and the coverage you should consider in a policy.

Choosing the Right Insurance Company

The popularity of manufactured homes has increased the availability of homeowner’s insurance and most of the major carriers have products to accommodate this market.

Foremost Insurance

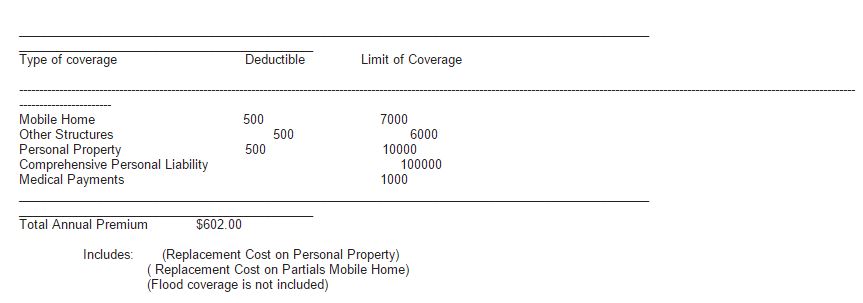

One of the most popular insurance companies for a manufactured home is Foremost Insurance. They have been covering mobile and manufactured homes for more than 50 years and are a leader in the industry. I recently got a quote from Foremost for my own 1978 single wide home and the rates seemed reasonable. We are wanting to install a wood stove and our current insurer is going to drop our policy so I used Foremost’s website to obtain a quote with a wood stove. I also opted to insure our detached garage and building which was not an option with our current policy. Here’s the quote they emailed me a few days later:

An annual cost of $603 is substantially higher than our current insurance policy of only $230 per year but it covers a lot more with a lower deductible and allows us to have a wood stove.

Please note: I am not being paid by Foremost and have no relationship with them. This is simply my experience in obtaining a quote.

Other Companies that Offer Manufactured Home Insurance

I tried to get quotes from a few other insurance companies as well but all the others stated they could not offer me a policy. I suspect it was due to the wood stove. Here’s a list of companies that offer manufactured home insurance. Just click the link to be taken to their website.

Things to Consider When Choosing an Insurance Company

When you are looking for the right company, here’s a checklist of things to consider.

- How long has the company been providing manufactured home insurance? Even though a company boasts of a long history in the insurance industry, this is a niche market and requires experience.

- Go to http://www.ambest.com/ to locate your company’s insurance rating. Good ratings range from A++ to B+. Insurance companies below B+ according to A. M. Best Company’s guidelines are not as secure as those with higher ratings. Don’t let an inexpensive premium be your guideline for selecting your insurance provider.

- You should have several levels of insurance to choose from. Insurance companies usually have products with minimal coverage to those that are fully loaded.

Coverage

Your home is probably your most valuable asset. Protecting it and your personal property is a primary concern for most homeowners. Manufactured homeowner protection can range from a basic policy, which protects your property against natural disasters, explosions, and other unpredictable occurrences, to a comprehensive one, which includes the replacement cost of your home.

The best coverage is what makes sense to you.

- When speaking with an agent make sure that several levels of coverage are quoted.

- Take an inventory of your valuables inside your home and the cost to replace them.

- Keep in mind that most companies cover your land and other buildings that are attached such as storage sheds and detached garages.

The location of your manufactured home will also help determine your level of coverage. Weather is, of course, a huge factor, and the severity of certain conditions will help to drive specific types of coverage. Protect your home against windstorms, falling trees and objects, hail storms, and a host of occurrences that manufactured homes are usually more susceptible to. These occurrences are most often minor, but the cost to repair can put a serious dent in your budget.

Related: How to File an Insurance Claim for Your Manufactured Home.

Average Home Insurance Rates by State

Below is a chart depicting the average insurance rates per state by StaticBrain.

| 1 | Florida | $2,280 |

| 2 | Oklahoma | $1,572 |

| 3 | Louisiana | $1,483 |

| 4 | Arkansas | $1,014 |

| 5 | Kansas | $1,004 |

| 6 | Texas | $986 |

| 7 | Missouri | $949 |

| 8 | Alabama | $933 |

| 9 | Minnesota | $926 |

| 10 | Mississippi | $907 |

| 11 | Nebraska | $887 |

| 12 | West Virginia | $875 |

| 13 | Kentucky | $874 |

| 14 | Georgia | $833 |

| 15 | Tennessee | $801 |

| 16 | Connecticut | $799 |

| 17 | California | $795 |

| 18 | Colorado | $795 |

| 19 | Indiana | $781 |

| 20 | Illinois | $760 |

| 21 | South Carolina | $679 |

| 22 | Maryland | $645 |

| 23 | Wisconsin | $644 |

| 24 | Montana | $640 |

| 25 | New Jersey | $638 |

| 26 | North Carolina | $631 |

| 27 | Delaware | $629 |

| 28 | Iowa | $624 |

| 29 | New York | $622 |

| 30 | Pennsylvania | $621 |

| 31 | Ohio | $621 |

| 32 | Nevada | $584 |

| 33 | New Mexico | $582 |

| 34 | New Hampshire | $581 |

| 35 | Virginia | $570 |

| 36 | Washington | $569 |

| 37 | Arizona | $559 |

| 38 | Vermont | $556 |

| 39 | Oregon | $484 |

| 40 | Utah | $441 |

| 41 | Idaho | $405 |

| 42 | Wyoming | N/A |

| 43 | North Dakota | N/A |

| 44 | South Dakota | N/A |

| 45 | Michigan | N/A |

| 46 | Massachusettes | N/A |

| 47 | Rhode Island | N/A |

| 48 | Maine | N/A |

| 49 | Alaska | N/A |

| 50 | Hawaii | N/A |

Flood Insurance

Keep in mind that flood insurance is separate from homeowners insurance. Visit Floodsmart.gov to learn more about obtaining the right flood insurance for your home.

How Much does it Cost?

The answer to this question is highly dependent on the level of coverage that you are comfortable with. It also depends on the value of your home and other buildings located on the property. Usually, rates are quoted from the low end of $250 to a high end of $1,300 per year. If you are underinsured, consider that a catastrophic loss may not be covered.

Sometimes insurance for manufactured homes is just as expensive as traditional homes. The incidents of claims filed are higher, because of greater exposure to natural disasters. Even though the overall financial investment for manufactured homes is usually less expensive, insurance for manufactured homes can be just as costly as with other structures.

Do I Really Need Homeowners Insurance?

While most wouldn’t even ask this question, some homeowners choose to take a calculated risk, especially if they feel their cash reserve is sufficient to cover most losses. However, no matter your personal financial situation homeowner insurance is a safer bet.

Insurance coverage is often very comprehensive and will cover accidents in the home, which can cause property damage, to injuries incurred by a guest who slipped and fell on your porch. Also keep in mind that if your home is deemed uninhabitable because of a natural disaster, only an insurance policy can minimize the cost to replace your home.

Thanks for reading Mobile Home Living!

We own a 1986 manufactured home with a large (48*12 ft) wood front porched and an aluminum small back screen room. Zone X not in a flood zone but 3 blocks to a bay off the Gulf. In Michael we lost the roof and porch so they are both new. There is an older vinyl shed and metal carport on the 1/2 acre property. This years insurance is over $2200 and has much less coverage with limits so low and restrictions so high that hurricane, wind and water damage are not even covered. Possibly fire or a neighbors falling treewould still be covered. Personal property coverage it now limited to $500 for almost a personal property categories and of course the deductibles increased. We have been told that Peoples Insurance is the only MH insurer for older homes. Does any one have any suggestions for Gulf County FL? The major insurance companies don’t cover MH more than 10-15 years old in our area..Ours is over 30. Our escrow way exceeds our principal and interest portion of our mortgage. Can any one suggest a company that would cover us?

We have a 1999doublewide on a permanent foundation. We currently have Farm Bureau, and have used them for 30+ years, and auto also. Our policy is851.00 a year. I am wanting to find something cheaper. Can someone give me some suggestions. Thank you so much. Carolyn . I live in North Carolina

Thanks Mona!

Thanks for the info, Mona! Appreciate you letting us know!

I just looked up PACIFIC SPECIALTY, & they have a “A” rating, & states they are in ALL 50 states! Been in business a long time, too! Maybe I will insure with them.

I live in Ca, State Farm will NOT Insure if your carport doesn’t have 4 Legs! They say it’s a New thing! I called Allstate & they insure with Pacific Speciality, $ 438/year, $100,000 home, $50,000 personal prop, $10,000 outside structures, 100,000 personal liability, etc. with $500 deductible. Pretty Good price, but I’ve never heard of Pacific Specialty!? Going to check Foremost next….

Good luck and thanks for the tips! It takes a lot of patience getting quotes but it usually always pays off in the end. Let me know how it goes!

If you live in NC Farm Bureau has been excellent and very easy to insure our double wide. Grant it, the past year they keep going up so this year it is time for me to start looking. It’s the first of February now and mine isn’t due to renew until the middle of March so that gives me a few weeks to consider what else I can find out there. It began with a little over $400 and over the past four years is up to over $600. Yes, time to start looking. We were with Geico, which contracts their mobile homeowners insurance through Assurant, or rather they did, unsure what route they take now. Just keep shopping around, have your policies out when you talk to these insurance companies. You may can cut a little here and add more there and still come out with a better premium. It’s all about shopping around and be committed to finding the best product for the best price. We usually insure our home and vehicles together and that usually gets us a better price and next year I’ll turn 55 so with some companies they give you a discount with that too. Military, certain businesses do as well, so don’t be afraid to ask. At times if you play stupid which we’re not, you’ll get more information too. O.o

Hi Ginger,

There’s a disconnect with insurance for manufactured homes (even though they have a lower rate of fire damage than a site-built home). The companies seem to make up their own rules as they go along. Every company is different and every finance company will require a minimum amount of insurance to cover the loan payoff and protect their investment so that will need to be considered as well. Once the loan is paid off the insurance considerations change.

You may want to call a competitor and see what they can offer and if their policy is similar.

Best of luck!

Is your manufactured home considered real property in the county you live? I live in Person County, NC and it is classified as real property by the tax assessor. Do you know if Erie will insure your home for replacement coverage regardless of the age of the home?

The company I am currently with has me insured for replacement value until the home gets 20 years old. Then they will come out and take pictures and determine if the home has been maintained well and then they might insure it for replacement value for another 5 years and after that they say they can only insure it for as is value. Does that sound right to you? This is my home permanently affixed to my land and I didn’t know that this was even a possibly an issue that would be coming up.

Hi Susan,

Google American Modern Insurance. They were the only ones that would insure my 1978 single wide. It’s always a pain trying to find a company that will insure mobile and manufactured homes.

Need Mobile Home Insuance only. Tried of being over charged to cover my home. 361 676-9960 Foremost won’t cover me anymore.

Thanks so much for the information! I appreciate you taking the time to write this out for us!

I know I’m way behind in this conversation, but we live in Nashville, have a 20-year-old manufactured home on 2.3 acres and we have Erie Insurance. We currently pay 992.00 but we have a very good policy(as compared to what others have offered us). Other companies quoted us 13-1700.00 for less coverage. Erie did require us to fill out numerous forms as far as construction, tie downs, foundation, but everything went through without a hitch. We also had them for our log cabin home insurance(another home many companies won’t insure) and our cars. They’ve been great. If you live in middle Tennessee, Wilson Bank and Trust in Lebanon, TN does offer home equity loans on manufactured homes. It took a while to go through, but we did receive a good size loan and rate which we can easily pay. They’ve been great, also.

Hi Jimmy!

Owning a manufactured home does have some issues and insurance is one of the biggest. I’ve heard story after story, just like yours, and it isn’t fair. Especially since its been proven that manufactured homes are less likely to have a house fire (Foremost did a study and proved that site-built homes have 18 fires out of 1000 while manufactured homes had less than 10).

I have several family members that have forgone homeowners insurance because they would rather have a coal stove (we are in the coalfields after all) and insurance is way to expensive if you have one. They put a little in savings and that’s it. It’s 2015, homeowners of any kind of home should not have to make that decision!

Thanks so much for sharing your quotes with us. I think it helps a lot of people understand the differences in states and home types. I appreciate you reading MHL too! Thank you!

We are in a wind zone 3 mobile home requirement area and not in a flood zone. Progressive quote was way up there 6k i think, geico subs it to assurant we you do it online ,that is who we have it with now but it is still $4000/year and only covers the house for 30k and content 15k. No way we could replace this double wide for 30k cost close to 9k just to move one, we just moved this one here last year. We just requested a quote from foremost to see what their price is. We are debating now on just dropping it all together and put the money in savings and get the content only coverage through state farm with is like $30/month. we used to have coverage on a 200k house in this area and paid 2k/year.

Thanks for the info Karen! It’s always good to know how others are fairing! Hopefully, as manufactured homes and tiny homes gain ground we’ll have it easier.

Thanks for reading MHL!

We ran into problems trying to find insurance when we first bought our manufactured home almost 10 years ago.. We ran into the “attitude” quite a bit, with offers of very hefty insurance rates, until we contacted a local insurance company, which is an independent agency that insures through many companies. They always do a search each renewal to make sure we’re getting the best deal.. here in Michigan, our insurance runs around $400 for the year, which is very affordable.. We have our car insurance through progressive (which our agency also insures through), but they will not insure a manufactured home. I once tried Geico just to see if their rates were any better, and they will not insure a manufactured home, either.. I don’t get it!

Smart choice Allison! Insurance seems to be a rich persons game that not all of us can play. We are without insurance right now just because I want to install a very small wood stove.

My family here in southern WV cannot get affordable insurance on their manufactured homes because they have coal stoves. Never mind that we are in coal mining country and know coal inside and out – it’s practically breed into us at birth…lol. Thankfully, none that I know have had any issues with their stoves!

Maybe you can just get insurance on the contents of your home, something like renters insurance? Then, your savings account could be used just for the structural issues that may occur during a tragedy. I do wish you the best – hopefully, we can all find insurance that is affordable one day!

Good luck to you!

Unfortunately, homeowners insurance near the Gulf coast is prohibitively expensive for MHs. We are in Wind Zone 2, and the premium quoted on our 2007 doublewide was nearly $1000/a MONTH; this was a new replacement value ($75K) policy with no options for a lower value and only one company offering any insurance at all.

Since we only paid $25K for the house, paying this amount meant we would essentially be buying our house again every 2 1/2 years. We opted for a savings account instead.

Thanks so much for letting us know about them! It really shouldn’t be hard to find proper financing and insurance for a home that 20 million people live in.

Got my loan and insurance through CountryPlace Mortgage out of Fort Wort, TX. I had a lot of people turn me down for a loan. But CP took care of me. I highly recommend them.

Thanks so much Sharon! Every little bit we of information we can get will be helpful!

Great article. I live in FL and was just quoted $1,955.74 by HomeFirst. They said they would need to run an evaluation based on the age of the home. I’m sure I can get a better deal than this. Will keep you updated

$100,000 dwelling

$25000 personal property

$500 adjacent structures

$25000 liability