If you need a sudden mobile home repair and don’t have the money, what can you do? What options are available to elderly or disabled mobile home owners that don’t make a lot of money but need their homes repaired? Fortunately, there are a few low-income home repair loans available.

We’ve gathered several federal and state programs and even a few private funding options available to eligible applicants.

We’ve previously written an article titled 18 home improvement and grants for your manufactured home remodel but this article will focus specifically on ideas and programs for elderly, disabled, and low-income families that need help and may not have the credit scores or income needed to get standard loans as we shared in the other article.

USDA Programs for Low-Income Home Repair Loans

More than 60 million people live in rural areas in the US. Most mobile and manufactured homes are in a rural area so it makes sense that we start with the USDA.

The USDA stands for the United States Department of Agriculture – Rural Development. It focuses ‘providing financial resources and support for rural communities, residents, and businesses’. The USDA defines rural populations as an area that has less than 20,000 occupants living outside of metropolitan areas or urban areas if the population is less than 10,000 with a major lack in mortgage credit.

The USDA has many loans and grants available to homeowners, tenants, and businesses, this link will take you to a list of their most popular programs.

Section 504, The Rural Repair and Rehabilitation Loan and Grant Program

The Rural Repair and Rehabilitation Loan and Grant Program, also known as the Section 504 loan and grant fund, is a USDA program that can help with mobile home repairs and upgrades if the following restrictions are met (verbatim from this form):

Repairs to Mobile or Manufactured Homes Section 504 loan and grant funds can be used to repair mobile or manufactured homes if:

- The applicant owns the home and the site and occupied the home prior to filing an application;

- The repairs are needed to remove health or safety hazards; and

- The home is on a permanent foundation or will be put on a permanent foundation with Section 504 funds.

A permanent foundation is defined as either: (1) a full below-grade foundation; or (2) blocks, piers, or some other type foundation with skirting and anchoring with tie-downs.”

The program is only open to people that meet the following controls:

- Be the homeowner and occupy the house

- Be unable to obtain affordable credit elsewhere

- Have a family income below 50 percent of the area median income

- For grants, be age 62 or older and not be able to repay a repair loan

You can find Rural Repair and Rehabilitation Loan and Grant Program application here. This form is a complete checklist for the program’s guidelines and requirements.

The USDA has Low-Income Home Repair Loans

Here’s a brief list of mobile home repairs and improvements the USDA loans and grants can cover:

- Roof repair or replacement

- Insulation, doors, caulking, and storm windows

- Wood burning stoves that meet safety requirements

- Repair of structural supports

- Room addition for large families

- Provision repair for sewage and water systems

- Reasonable connection fees

- Wiring

- Repair needed due to previous occupants

- Fee payment on loans

- Accessible to handicapped (if needed)

- Flood insurance

Learn Where to Find Mobile Home Parts and Supplies Here

Additional USDA Programs for Mobile Homeowners

If you dream of having a small mobile home on a large farm then the USDA should be your first stop. You may be eligible for a loan or grant.

There are programs to help low-income families purchase homes, too. Section 502: The Direct Loan Program helps low-income applicants obtain safe and sanitary housing in eligible rural areas by providing payment assistance to increase an applicant’s repayment ability.

The Single Family Home Loan Guarantees can help lenders to provide low-income households the opportunity to own adequate, modest, decent, safe and sanitary dwellings as their primary residence in eligible rural areas. There also have loans for families wanting to get started in farming. You can see more loans here.

Read about the Top 3 Mobile Home Makeover Ideas that Add Value

HUD Programs for Low-Income Home Repair Loans

HUD is the U.S. Department of Housing and Urban Development. They handle housing issues throughout the country. But they have home repair loans, too.

FHA / Title I

The FHA Title I loans are a little-known financing tool for home improvements and repairs. Buyers can also piggyback a Title I loan onto their purchase mortgage to fix up a property they’re buying.

The loan must be funded through a lender that is approved for Title I loans and must be used to finance repairs or improvements on a residence that has been occupied for at least 90 days.

- Loans of up to $7500 are available as unsecured for a manufactured home that is not considered real property.

- If the manufactured home qualifies as real property loans are available for amounts up to $7,500 unsecured to a maximum of $25,090 secured

A minimum loan term of 6 months applies to both with a maximum of 12 years and 32 days for a manufactured home only and 15 years and 32 days for a manufactured home considered real property.

There are several home mortgage and home repair programs backed by HUD. If you want to buy a home anywhere HUD should be your first stop. This link, from a private lender, has a complete list of HUD programs available in each state.

Weatherization Programs and Low-Income Home Repair Loans

Energy.gov has a program that can help homeowners weatherize their homes at little to no cost. Here’s what the Energy.gov site says about the program:

Under DOE guidelines, you are automatically eligible to receive weatherization assistance if you receive Supplemental Security Income or Aid to Families with Dependent Children. In other cases, states give preference to:

- People over 60 years of age

- Families with one or more members with a disability

- Families with children (in most states).

Nationally, as many as 20–30 million U.S. families are eligible for weatherization services. DOE urges you to contact your state weatherization agency to determine if you are eligible for the many benefits of weatherization services.

These weatherization programs are run through a state weatherization agency. A majority of these weatherization agencies are nonprofit organizations that contract energy professionals. Therefore, you will need to research for your state’s advocacy department. For example, I would Google search ‘West Virginia weatherization program.’ Click here for more information.

LIHEAP

LIHEAP stands for the Low Income Home Energy Assistance Program. It helps low-income families pay for their heating bills in the winter. While it’s not technically a home repair program, it may help you save just enough money to get a much-needed repair. You can see the state LIHEAP programs here.

Energy Star Tax Credits and Rebates

ENERGY STAR® is a government-backed symbol for energy efficiency. providing simple, credible, and unbiased information that consumers and businesses rely on to make well-informed decisions.

EnergyStar has rebates and tax credits available for homeowners that buy EnergyStar products. Some of these rebates are pretty good, too. Click here to read about the programs and eligibility.

Click here to go to the ENERGY STAR Rebate Finder.

Layaway Programs Can Help Just as Much as Low-Income Home Repair Loans

Kmart Layaway

Kmart is well-known for its layaway program. I remember when they stopped doing it and everyone complained so they brought it back.

Walmart Layaway

Walmart has a holiday layaway program that begins in September. There’s no interest and you only need 10% or $10 to put down, whichever is most. You can layaway small appliances and large furniture.

Note: Be careful of Walmart.com. They are essentially a wannabe Amazon and other companies sell their stuff on the Walmart website. If you buy something from another seller you do not get the benefits that you would with a Walmart product.

I ordered a dresser on Walmart.com that arrived damaged. I struggled to get that thing in the back of our little SUV and drove it to the nearest store thinking I could just return it (still in the box, I didn’t even take it out since the damage was on a top corner). They wouldn’t take it. I had to email the seller for 4 months before they finally sent me a new one.

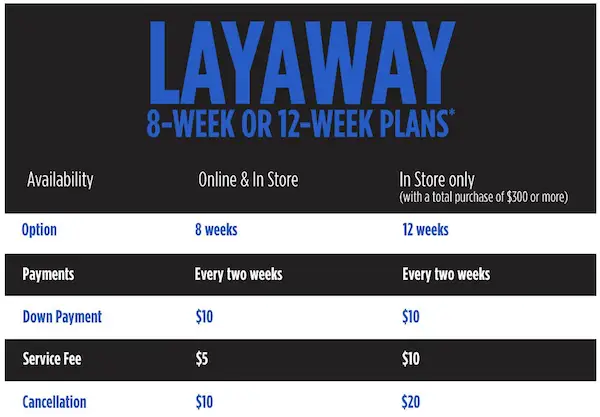

Sears Layaway

Sears has an 8-week layaway program that will help you with home improvement and appliances.

Mobile Home Parts Store Layaway

Mobile Home Parts Store offers a layaway program to get all your mobile home supplies for your remodeling project over time. It’s a great way to tackle one project at a time without a loan.

Alternative Methods for Low-Income Home Repair Loans

When you hear low-income home repair loans, you usually think about banks but credit cards are loans too. Hear me out on this – I’m not a fan of credit cards but if you use them responsibly there are a lot of benefits like cashback and extended warranties.

6 Months Same as Cash Offers on Credit Cards

I’m hesitant to even mention these but you have to do what you have to do sometimes. If you have no savings and your refrigerator or stove stops working what are you supposed to do? You have to feed the family!

While I’m not a big fan of credit cards, some can be handy to have. Lowe’s, Home Depot, Menard’s, and Tru Value all have no-interest programs if you use their credit cards. You can get the materials you need to repair your home immediately and if you pay the balance off within the allowed timeframe you won’t have to pay interest.

Usually, it’s a 6 month same as cash program if you spend at least $1,000 but I’ve seen 18 months same as cash offers for purchases over $2,500. This can be a great way to establish or increase your credit score while also remodeling your home. As long as you pay it off quickly you’ll be fine.

Volunteer Programs for Mobile Home Owners in Need

School Volunteer Programs

My daughter’s school makes every student do volunteer work every year. Freshmen must volunteer 5 hours, sophomores 10, and junior and seniors need 30.

If you are elderly or disabled you may eligible for these volunteer programs. Contact your local high school and ask if they have a building or construction program or if you can get some volunteer time to help repair your home (again, only elderly and disabled should try this).

If your town has a trade school that has a construction program (or plumbing, electrical, etc), you could call and ask for help. You’d need to furnish the materials and pull the permits yourself but the opportunity for free labor is there.

Local Government Programs

A lot of small towns and counties across the nation get federal grants for neighborhood revitalization and energy-saving programs. You can call your local courthouse or city hall to see if they can help.

Church Ministry Volunteer Programs

Southern WV gets a lot of out-of-state church groups that come in and do volunteer work for elderly and disabled homeowners. Of course, southern WV is the poorest area in the nation so that may be why they chose the area every year.

Still, calling your local churches can’t hurt (and actually attending church services before you ask for their assistance would always be a good idea).

Habitat for Humanity

Habitat for Humanity does a lot more than just build houses. They have neighborhood revitalization programs and financial education services. You can learn more about their programs by clicking the link.

Conclusion

As you can see, there are options for low-income home loans and several programs for mobile home owners in need.

Mobile home repairs can be financed by federal loans, state grants, or private lender programs.

Do you have a tip for low-income home repair loans? Know of any volunteer programs for low-income, elderly, or disabled mobile home owners to help get their home repaired? Let us know about them in the comments below.

Thanks for reading Mobile Home Living®.

I have a leaking on top off my trailer top need repair help please I don t. Want to have moles in my home. mole will kill you ok

Is there a program that helps replace the roof of my Manufactured Home. My wife and I are retired and have limited income. I have been disabled since 2012.

I’m 57 years old single woman living on disability and I can not afford the multiple repairs my manufactured home needs. All the links everyone is being directed to in previous comments seem to just be links to Lending Tree. I’ll never be approved for a loan so I’m looking for a program that will help me with all the costs. HUD and Blue Water Community Action tell me they won’t help people who live in manufactured homes. Please state exactly what link ur referring everyone to or tell me exactly what website to go to so I can apply for help somewhere. I’m not in my 60’s yet, it’s a manufactured home, I’m single and VERY low income

There may be some programs available to you locally. I would ask around at your local social services department to see if they can be of any help.

I am 79 years old i live i in my moble home with my disabled son the moble home is falling apart what can i do

I am a single parent I need help repairing my home for me and my son . Who can I speak to to get started I live in Michigan and winter months are coming quick.

to whom this may apply. I have a friend that is 66 years if age. her health is not the very best. for the past few years she was taking care if her younger brother that was which was on kidney dyisas 3 times a week. she would drive him 2 hours one way and another 2 hours home. he was in his late 50s on oxygen. She owed this little tiny trailer it wasn’t much but it was hers. it was a place she called home. one morning her brother awoke wanting a cigarette but did not turn of the oxygen machine. that morning was a very very sad day for this lady that with in mintues her trailer went up in flames and while we were able to get her brother out he did not make it he passed away. this lady that had all but a pile of ashes and nothing left of what was hers. then someone that I am grateful for donate her a trailer that she can call hers once again. but it is in deeply in need of repairs. she has been trying to clean up her brothers place before the city takes it that now winter is here and she needs to get her trailer her home liveable for her. so she can start to live a life once again. please help her if you can please

to whom this may apply. I have a friend that is 66 years if age. her health is not the very best. for the past few years she was taking care if her younger brother that was which was on kidney dyisas 3 times a week. she would drive him 2 hours one way and another 2 hours home. he was in his late 50s on oxygen. She owed this little tiny trailer it wasn’t much but it was hers. it was a place she called home. one morning her brother awoke wanting a cigarette but did not turn of the oxygen machine. that morning was a very very sad day for this lady that with in mintues her trailer went up in flames and while we were able to get her brother out he did not make it he passed away. this lady that had all but a pile of ashes and nothing left of what was hers. then someone that I am grateful for donate her a trailer that she can call hers once again. but it is in deeply in need of repairs. she has been trying to clean up her brothers place before the city takes it that now winter is here and she needs to get her trailer her home liveable for her. so she can start to live a life once again. please help her if you can

I would try to reach out to someone at the California Housing Development, they have an entire department for manufactured homes. this is their website: https://www.hcd.ca.gov/manufactured-mobile-home/mobile-home-ombudsman/index.shtml

Hopefully, they will be able to point you in the right direction to get you some funds to make your improvements.

To whom it may concern,

How do I apply for a grant to replace the perimeter framing of my double wide mobile home?

The framing has wood rot and is collapsing.

This would leave me homeless and I am a 64 year old disabled senior who lost my house to medical costs.

I purchased a mobile home and now it’s failing me.

I am on Medi/Medi also SNAP and cannot pay to do the repairs and could not survive on the streets with my multiple health issues.

I’ve been trying to get help for years and finally found you as a resource through Congressman Raul Ruiz’s office.

Please tell me how to apply and get my home repaired so I can stay in it in this hot desert.

Sincerely,

Val Crotty

I live in Fl, Im 63 and roommate is 80 both have had heart attacks and Im disabled, I managed to buy an air conditioner 2 years ago was great this year iv seen my bill for the last 3 months, 303.00. 356.00.415.00 and its 80 during the day, i called an ac guy to look thinking it was a hole in the duck, nope cant be that easy, he says my insulation is all falling down, I dont even get enough disability to pay rent so hiring a company to do it is like OMG. Plz if anyone knows anything or anyone that can help, Iv made a bunch of calls most don’t call back. Oh yea I own the mobile home but not the land. Plz can anyone help??? Thank you

I’m ssi disability an my home is RV camper an I live in a RV park an I was told I could not get any help unless I move out of my camper an get rid of my dogs. My dog is for my emotional support. An I live alone . I have family that may help with the way the economy is now that a huge problem . My parents are struggle themselves right now. My mother was in the hospital back in Nov with the covid an was realeased in Jan an she can no longer work an my step dad tries to help me best he can but he has to provide for his home an my mother an their bills with my mother no longer able to work that put an impact on their living situation. I only get disability as an income an I need some repairs made to my camper that I live in. The electric needs repaired so plug in work some dont an floors need some repair an windows I recently silicon shut so they would stay closed an have to tie my dog shut an I r in electric heaters . My step father helps me as much as he can as far as repairing what he can or tries to find someone to do Lil bit things an has to wait on paying them . he tries having things fix when he think he have a Lil bit of money to pay them for doing it. An I make it do since I cant afford to do any maintance myself to get it done . I’m in need of help doing repairs for my home . please help me .

Hello..

I live on Long Island and so the USDA cannot help me. I am a senior on SSD and have called many organizations who refuse to help me because I do not own the land. I own my mobile home unit but pay rent on the land. Anyway, my entrance (deck, stairs and railing) are quite dangerous at this point. Everything is loose and about to collapse. Help!!!

This site is very informative for senior citizens. I wish I knew where to find a free fixer-upper mobile home. I am a widowed senior citizen who is currently homeless and am staying with a relative. I love my kinfolk but there are a lot of times a woman my age (62) needs privacy and need less evasive foods to eat. I need a place where my grandchildren can visit their mema. I can’t afford to buy a new home and I’m not into fancy. Just a simple, easy and functional home where I can sleep, eat and relax in peace. Please, someone answer my prayers. I will pay it forward. Thank you for taking time to read. May God Bless and keep you.

Hi Tracey,

These tips are great places to start. Go down the list and you should be find something or someone that can help. Best of luck!

Hi Carol,

Def follow these tips to try to get it fixed. Perhaps your local church could help. Best of luck!

I desperatly need to repare my mobil home roof it leaks

I too need help with my mobile hoke roof and floors I cnt afford much please help

Hi Shirley,

This article is a great resource for you then. Click on the links to get more information about each suggestion. Best of luck!

I need help .My mobile home is falling apart and I don’t have the money to fix it My income is low. I need help.

Hi Becky,

Most of these are on a national level but you will need to go through local agents to apply. Follow the links in the article and it will tell you more about whichever loan you are interested in and how to apply.

Best of luck!

hi Crystal, i was just reading your article on grants and loans for mobile home repairs. what state do these opportunities exist in i happen to live in Michigan and can not afford the repairs i need to do.i am a 67 yr old with my husband who 75 yr. we both re in declining health ,we need some repairs. who would i contact. my home is permanently set with 5 acres of land. i would greatly appreciate any information you could help me with. thank you for this amazing site,it is like my dream to see what can be done in mobile homes.