Believe it or not, there are a couple of different manufactured home financing options available through government programs. Figuring out what types of manufactured homes are acceptable and how to apply for the FHA loans can be complicated. Programs seem to come and go and eligibility requirements change.

This is our attempt to help potential buyers and current homeowners learn more about government-backed loans and the various other manufactured home financing options available to them.

Related: Low-Income Home Repair Loans and Programs to Help Mobile Home Owners in Need

FHA Loans

Manufactured homes are eligible for FHA loans but there are a lot of hoops to jump through. Still, using a government-backed program will likely save you thousands of dollars over using private manufactured home dealer financing.

What is an FHA Loan?

An FHA loan is a loan guaranteed by the U.S. Federal Housing Administration. Wikipedia defines the FHA as:

The FHA sets standards for construction and underwriting and insures loans made by banks and other private lenders for home building. The goals of this organization are to improve housing standards and conditions, provide an adequate home financing system through insurance of mortgage loans, and to stabilize the mortgage market.

FHA loans have given many families the opportunity to buy a home. FHA loans require much lower down payments, lower credit scores, and lower interest rates.

These government-backed mortgage programs are possible through the use of mortgage insurance policies like PMI (private mortgage insurance), MMI (mutual mortgage insurance, and UFMIP (upfront mortgage insurance premium).

FHA Loan Requirements

Only eligible banks or private lenders can issue FHA backed loans. You can click here to be taken to the HUD search page and find eligible lenders in your area.

FHA loans are far less stringent than private mortgage lenders. Most people will admit that saving up for a down payment is by far the hardest aspect of buying a home. It’s hard to save money when you have to spend most of it to live!

Learn more about what you need to know before you buy a mobile home here.

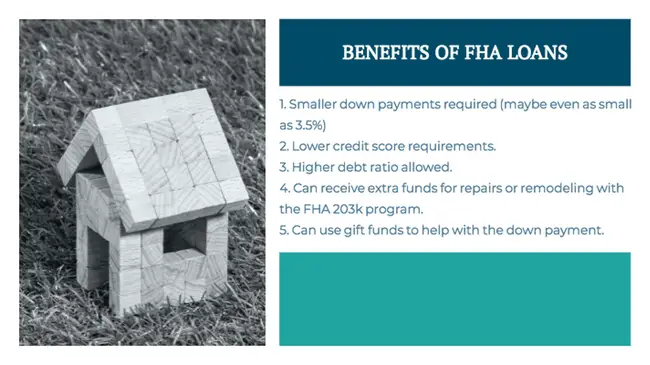

Benefits and Drawbacks of an FHA Loan

FHA backed loans opens the market up to homebuyers that normally wouldn’t be eligible for private mortgages. Some of the benefits of FHA loans include:

- Smaller down payments required (maybe even as small as 3.5%)

- Lower credit score requirements.

- Higher debt ratio allowed (the amount of credit you have available to you versus the amount you have used).

- Possibility to get extra funds for repairs or remodeling with the FHA 203k program

- Can use gift funds to help with the down payment

Requirements for FHA Loans

Permanent Foundations

FHA loans require that manufactured homes be secured onto a permanent foundation to be eligible for a mortgage loan.

The foundation requirements for a manufactured home can be found in the Permanent Foundations Guide for Manufactured Housing (PFGMH).

The lender must obtain a certification by an engineer or architect, who is licensed/registered in the state where the manufactured home is located, attesting to compliance with the PFGMH.

If Alterations Have Been Made to the Manufactured Home

Alterations to a manufactured home may pose issues for a loan applicant. Lenders must ensure the alteration was addressed in the foundation certification. If the additions or alterations were not addressed, the lender must obtain:

• an inspection by the state administrative agency that inspects manufactured housing for compliance; or

• certification of the structural integrity from a licensed structural engineer if the state does not employ inspectors.

Manufactured Home Financing Options: Title 1 Loans

According to the HUD website, a Title I loan can be used for the purchase or refinance of a manufactured home, a developed lot to place the home, or a home and lot combination. The home must be the borrower’s principal residence to qualify.

FHA approved lenders work with the Title I program to make the loans from their own funds and the Title I program ensures those loans in case the home buyer defaults.

A homeowner does not have to purchase or own land that their manufactured home is going to sit on.

Borrowers may lease a lot in a manufactured home community and still qualify for a loan as long as the lease is for a lease term of at least 3 years. Also, the lease must include a provision that the owner will receive at least 180-day notice if the lease is going to be terminated. This is in place to protect the homeowner in case a community closes.

Loan Amounts/Terms and Borrower Requirements

Maximum Loan Amounts

- $69,678 – Manufactured home only

- $23,226 – Manufactured home lot

- $92,904 – Manufactured home & lot

Maximum Loan Terms

- 20 years for a loan on a manufactured home or on a single-section manufactured home and lot

- 15 years for a manufactured home lot loan

- 25 years for a loan on a multi-section manufactured home and lot

Borrower Requirements for Title 1 manufactured home financing options:

- Have enough funds to make the minimum required downpayment.

- Be able to prove their income to make the payments on the loan and meet their other expenses.

- Intend to occupy the manufactured home as their principal residence.

- Have a suitable site to place the manufactured home. The home may be placed on a rental site in a manufactured home park, provided the park and lease agreement meet FHA guidelines. The home may be situated on an individual homesite owned or leased by the borrower.

Learn about 3 more manufactured home financing options here.

Keep in mind the manufactured homes must meet certain standards to qualify. The home must meet installation standards, carry a one-year warranty from the manufacturer (if new), and be placed on a site that meets the standards for the area.

See 10 Gorgeous Manufactured Home Models on the Market Today here.

New Manufactured Home Financing Options from Fannie Mae: The MH Advantage

In June of this year, Fannie Mae re-launched their program, MH Advantage, with a focus on helping to get more people into manufactured homes with comparable features of a stick-built home.

The MH Advantage program offers benefits that aren’t found in some of the other manufactured home financing options available, such as:

- Up to 97% loan to value ratio which means the down payment for the new home

- can be as little as 3%

- Can be combined with HomeReady, HFA preferred, and other Fannie Mae products

- They waive the .50% loan level price adjustment

Keep in mind, these manufactured home financing options are only available to homes that are classified as real property (though we’ve read that they are looking into chattel finance).

MH Advantage Eligibility

A home must be designed and built to meet MH Advantage requirements. The goal is to ensure the homes appear more like a site-built home.

- Roofs will be higher pitched and have eaves

- The foundation will have a more low profile

- The addition of garages, carports, and dormers will be more standard

- The use of more durable siding material

- They will meet all energy efficiency standards

More than ten companies are participating in the MH Advantage program now. Clayton Homes, Cavco (which manufacture homes such as Fleetwood and Palm Harbor), and American Homes are just a few that are on board to provide a variety of home styles and designs to fit any family.

FYI: Every home that meets the MH Advantage standard will have an MH Advantage sticker affixed to it.

If you are interested in learning more about new manufactured home financing options Fannie Mae can help you. Click here to learn more.

The MH Advantage program just (re)started. Since it is a new program, we can expect to see modifications and requirement changes as the program matures and the Fannie Mae Duty to Serve Team (the team overseeing the program) sees fit.

Refinancing Your Manufactured Home Using HARP

If you already own a manufactured home and are having problems keeping up with the payments you may want to look into the HARP® program.

The Home Affordable Refinance Program, or HARP®, was established in 2009 by the Federal Housing Agency to help homeowners who are having problems with their mortgages.

Any mortgage owned by Fannie Mae or Freddie Mac is eligible for the HARP® program, including manufactured homes. Some of the eligibility requirements include:

- You must be current on your mortgage, with no 30-day+ late payments in the last six months and no more than one in the past 12 months

- Your home is your primary residence, a 1-unit second home or a 1- to 4-unit investment property.

- Your loan is owned by Freddie Mac or Fannie Mae. (You can use the Loan Look-up Tool on the site if you are unsure).

- Your loan was originated on or before May 31, 2009. (There is a loan lookup tool on the site to help you get the exact date).

- Your current loan-to-value (LTV) ratio must be greater than 80%. (you can find the value with a tool on the site)

Since the program started back in 2009, there have been many changes to the program.

To determine your eligibility:

- Get your financial information together (mortgage statements, all income details)

- Call your mortgage company to see if they are participating in the HARP® program, or call one of the lenders approved by HARP® and tell them you are looking to refinance

- Start the application process

The HARP® program will end 12/31/2018.

Learn about 18 Home Improvement Loans and Grants for Your Manufactured Home Remodel here.

Conclusion for Manufactured Home Financing Options

This article is just a quick look at a few manufactured home financing options available. If you are interested in learning more about these manufactured home financing options you will want to find a housing counselor and look into the vast information on this HUD page. You can also call HUD’s interactive voice system at (800) 569-4287.

Remember, the government programs don’t lend the money themselves. At most, they simply back the loans or offer benefits to reduce the risk that the private lenders face when making loans.

Do you have experience with these manufactured home financing options mentioned above? We would love to hear from you and learn more about your experience. Please leave a comment below.

Thanks so much for reading Mobile Home Living!

Comments

3 responses to “FHA Loans and Other Manufactured Home Financing Options”

SEEKING $45K MORTGAGE ON MY DOUBLE-WIDE MANUFACTURED HOUSE

DO NOT OWN THE LAND

DO YOU OFFER A PRODUCT FOR MY SCENARIO?

THANKS

Hi Susan,

Unfortunately, your chances of refinancing are slim unless you can get a personal loan from your bank and they would probably not want to to do it once they find out its for a manufactured home. The dealer told my brother-in-law that he could refinance to get a lower interest rate and get his parents off the loan (as co-signers) after a couple of years when he purchased his single wide. No one would touch it in WV regardless of employment or income or credit score – his home was financed through one of the builder’s finance companies.

I’d work on establishing a good relationship with your local bank (open accounts, get mini-loans and pay them off, etc.). Of course, every state is different so you may have a much larger market to work with.

Best of luck!

We have a double wide home on rented land . We have a Chattel loan with a high interest rate. looking to find a refinance loan . at a lower rate.